Beyond the Funnel: A Leader’s Guide to Navigating the Modern B2B Growth Divide

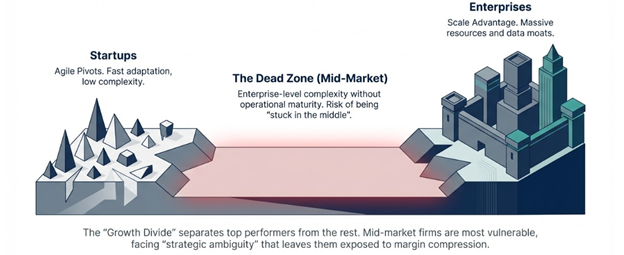

B2B enterprises are facing a significant challenge: the rise of a “Growth Divide.” This phenomenon splits the business landscape, separating a few top performers from their peers and creating a “dead zone” for those who fail to adapt. While agile startups can pivot quickly and large corporations leverage huge economies of scale, mid-market firms often find themselves stuck, dealing with enterprise-level complexity without the operational maturity to handle it effectively.

The main issue fueling this divide is the “Activity Trap,” a harmful situation in which increased sales efforts yield diminishing returns. Go-to-market teams are busier than ever, using a variety of technologies to create a storm of outreach. But this flurry of activity often hides a lack of real progress. The truth is that sales reps may spend only two hours a day on active, value-adding selling, with the rest of their time consumed by administrative tasks and low-value work. This disconnect between effort and results points to a deep, structural breakdown in the traditional sales model.

This article explores the obstacles causing this disconnect, from organizational silos to outdated sales processes, and offers a comprehensive, modern framework for building a predictable, scalable, and resilient growth engine. The following analysis provides a blueprint for leaders aiming to break free from the activity trap and navigate the complexities of today’s buyers.

The answer isn’t about working harder; it’s about working smarter. It requires a fundamental shift in strategy, moving beyond the linear sales funnel and the inefficiencies of siloed teams. It calls for a new, united, and relentlessly buyer-focused approach to growth.

The Great Decoupling: Why More Effort No Longer Guarantees Growth

Before leaders can reignite stalled growth, they must first understand its core cause. The problem is not a temporary market downturn or a failure of individual effort; it is a fundamental breakdown in the long-standing link between sales activity and revenue results. For decades, sales management was a straightforward equation: more calls, more meetings, more revenue. That equation is now broken.

The “Growth Divide” highlights the gap between organizations that have adapted to this new reality and those that haven’t. Mid-market firms are in a particularly risky position, often described as being “stuck in the middle.” They lack the sharp agility of smaller niche players and the overwhelming resources and data advantage of large enterprises. This strategic ambiguity often results in compressed margins and a confused market position, making them especially vulnerable to forces that are widening the divide.

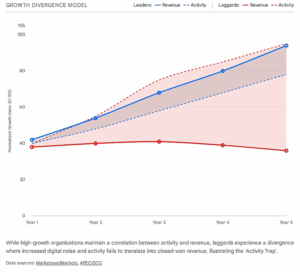

This split is clearly shown by the concept of “Activity-Revenue Decoupling.” The model depicts this divide, showing high-growth “Leaders” where activity and revenue rise together, while “Laggards” display a widening gap between rising activity and stagnant revenue. For Leaders, a smarter effort still yields results. In contrast, Laggards face a dramatic divergence. Their activity levels go up, driven by more technology and pressure to “do more”, but their revenue either stays flat or declines as the high volume of activity creates “digital noise” that doesn’t turn into closed deals. This is the Activity Trap at its clearest: a situation where the engine runs louder than ever, but the wheels don’t gain traction.

This decoupling isn’t a random market event. It’s a direct sign of specific, identifiable barriers inside the organization and its outdated approach to today’s B2B buyer. To close the gap, leaders must first identify these core issues.

Diagnosing the Three Core Barriers to Predictable Revenue

Overcoming the Activity Trap requires leaders to look beyond surface-level symptoms, such as missed quotas, and identify the fundamental issues hampering their go-to-market engine. Three major barriers stand out as the main causes of the growth gap, each reinforcing the others, creating a significant drag on performance.

Barrier 1: Organizational Silos and Strategic Confusion

The most critical internal obstacle is the strong misalignment between Sales, Marketing, and Customer Success. When these revenue-producing departments operate independently as silos, they create friction, waste resources, and deliver a broken customer experience. This dysfunction results from deeply rooted, conflicting incentives:

- Marketing is rewarded for lead volume, often sacrificing quality to meet MQL targets and “throwing leads over the wall” to sales.

- Sales is driven by bookings, often dismissing marketing-generated leads and focusing on their own prospecting.

- Customer Success is measured by retention, frequently handling customers who were oversold or whose expectations were mismanaged during sales.

The impact of this internal discord is serious. Companies with siloed teams can lose up to 10% of annual revenue due to these disconnections. The waste is measurable: 41% of marketing leads are rated as poor by sales, meaning nearly half of the effort and budget on lead generation is wasted before a real conversation begins.

Barrier 2: The Reality of the Modern, Non-Linear Buyer

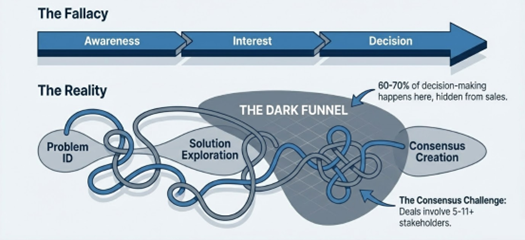

The second obstacle is the outdated linear sales process. Most CRM systems are designed around factory assembly-line logic, forcing a chaotic reality into rigid, sequential steps. However, the modern B2B buying journey is anything but linear. It is a complex, recursive, buyer-led process.

Gartner describes this process as a series of “looping” and overlapping “buying jobs”, like Problem Identification, Solution Exploration, and Consensus Creation, that buyers revisit multiple times. A buying group may appear to be in the final stage, only to have a new stakeholder join and send the group back

to redefine requirements.

This complexity is increased by two major factors:

- The Dark Funnel: Buyers now complete 60% to 70% of their decision-making through independent online research, peer reviews, and self-service tools before they ever talk to a sales rep. A large part of the journey takes place in the “dark,” out of sight for traditional sales teams.

- The Consensus Challenge: The average B2B deal involves 5 to 11+ stakeholders, each with their own needs and veto power. In this environment, the biggest competitor is not another vendor but “No Decision”, the inability of a diverse buying group to reach a consensus. This is a leading cause of lost deals, with almost a third of reps citing prolonged processes as a top reason opportunities fall through.

Barrier 3: Internal Complexity and Tech Overload

The final barrier is the burden caused by internal complexity. As companies grow, layers of bureaucracy, overly complex workflows, and complicated approval steps become a “silent killer” of growth. This internal friction disconnects leadership from the front lines and significantly slows decision-making. One study shows that 85% of CEOs blame internal factors, not market conditions, when growth stalls.

Ironically, the technology meant to fix these issues often makes them worse. The paradox of “Sales Tech Overload” has led to tool fatigue and mental burnout. Instead of helping sales, a bloated, poorly integrated tech stack wastes valuable time switching between apps and performing manual data entry. It’s telling that 45% of sales pros feel overwhelmed by the numerous tools they need to use, turning what should boost productivity into a productivity drain.

pros feel overwhelmed by the numerous tools they need to use, turning what should boost productivity into a productivity drain.

These barriers are not accidental; they stem from a long-standing “growth at all costs” mindset. During rapid expansion periods, many companies expanded “more of everything”- more reps, more leads, more tools – without a clear strategy tying them together. This culture rewarded activity over results and focused on narrow KPIs rather than shared goals, creating the silos and complexity that now block growth.

To tackle these deep-rooted issues, a new, integrated operational framework is needed, one that aligns the organization, recognizes the realities of the modern buyer, and simplifies the path to revenue.

The Hybrid Go-to-Market: A New Framework for Growth

Bridging the Growth Divide requires more than minor adjustments to the current model; it calls for a complete re-architecting of the commercial engine. The Hybrid Go-to-Market (GTM) framework offers the blueprint for this transformation. It is an integrated system designed to eliminate silos, align strategy with the modern buyer, and harness technology as a true force multiplier.

Part 1: The Foundation — Unifying the Engine with Revenue Operations

The strategic remedy for organizational silos is Revenue Operations (RevOps). RevOps is not just a new name for sales operations; it is a centralized function that unifies people, processes, and data across the entire revenue cycle.  A RevOps structure breaks down the traditional barriers between Sales, Marketing, and Customer Success by establishing a unified data layer and centralizing core capabilities under a single strategic framework. This comprehensive approach promotes alignment around shared revenue goals rather than isolated functional metrics. The effect of this alignment is significant; companies with

A RevOps structure breaks down the traditional barriers between Sales, Marketing, and Customer Success by establishing a unified data layer and centralizing core capabilities under a single strategic framework. This comprehensive approach promotes alignment around shared revenue goals rather than isolated functional metrics. The effect of this alignment is significant; companies with

well-aligned functions can achieve up to 208% higher revenue than their siloed counterparts.

For a mid-market enterprise, the ideal RevOps structure is streamlined and organized by capability, not by department:

- Systems: Manages the entire GTM tech stack (CRM, Marketing Automation, etc.) and its integration.

- Insights/Data: Handles analytics, forecasting, data cleanliness, and performance reporting.

- Enablement: Provides training and content for the entire revenue team (Sales and CS).

- Process: Enhances workflows and handoffs across the entire customer journey.

Part 2: The Strategy — Embracing a Dynamic Coverage Model

The Hybrid GTM framework redefines how sales teams interact with the market, shifting from fixed territories to a more flexible, intelligent coverage model.

- The Hybrid Rep: At the core of this model is the “Hybrid Rep,” a master of digital orchestration who skillfully combines remote engagement with impactful, face-to-face interactions. By reducing travel time, hybrid sales teams can cover up to four times as many accounts as traditional field teams, significantly expanding capacity and market reach.

- Vertical Specialization: The concept of territory evolves from static geography to dynamic, vertical-based specialization. Reps focus on specific industries (e.g., finance, healthcare), enabling them to gain deep domain expertise. This enhances their relevance, credibility, and ultimately, their win rates.

- The Cross-Functional Pod: To ensure smooth execution, teams are organized into cross-functional “Pods” or “Squads.” A typical mid-market pod includes Account Executives, a dedicated Sales Development Rep, and a Customer Success Manager, all focused on a shared set of accounts or a specific vertical. With aligned goals and incentives, the common misalignments seen in traditional models diminish.

Part 3: The Paradigm Shift — Prioritizing Buyer Enablement Over Sales Enablement

Perhaps the most significant change in the Hybrid GTM framework is the shift in mindset from “helping our sellers sell” to “helping our buyers buy.” This transition from Sales Enablement to Buyer Enablement recognizes that buyers now complete most of their journey independently. Consequently, the vendor’s main role is to equip their internal champion with the tools necessary to navigate their complex organization and build consensus.

| Dimension | Sales Enablement | Buyer Enablement |

| Focus | Seller Productivity | Buyer Decision Confidence |

| Primary User | Account Executive | Internal Champion / Buying Group |

| Key Assets | Scripts, Battlecards, CRM | ROI Calculators, Digital Sales Rooms, Diagnostics |

| Outcome | Activity Efficiency | Consensus Creation |

An effective Buyer Enablement Toolkit includes assets designed not for the seller to present, but for the buyer to use:

- Digital Sales Rooms (DSRs): Centralized, secure microsites containing all deal-related content (proposals, case studies, security documents). They provide the buyer’s champion with a single link to share internally and give the seller valuable engagement insights.

- Interactive ROI and TCO Calculators: Tools enabling the buyer to input their data and develop a customized, defendable business case for their finance team.

- Diagnostic Assessments: Self-service tools that help buyers identify and quantify their issues, creating urgency without high-pressure sales tactics.

Part 4: The Accelerator — Using AI as a Strategic Force Multiplier

Finally, the Hybrid GTM framework harnesses Artificial Intelligence as a strategic asset to escape the Activity Trap. The goal is not just to automate tasks but to enhance the entire sales team’s capabilities.

- Agentic AI Workflows: The role of AI is shifting from simple automation to “Agentic AI,” where autonomous systems can manage entire top-of-funnel workflows,

such as identifying prospects, conducting research, and drafting highly personalized outreach.

such as identifying prospects, conducting research, and drafting highly personalized outreach. - Human-in-the-Loop Architecture: Balancing AI’s scalability with human expertise is essential. In this model, AI handles data processing and content creation, while human sellers review and approve, ensuring quality and personalization.

- Predictive Analytics: AI-driven insights illuminate the “Dark Funnel” by identifying high-intent accounts before they engage. It also supports objective, data-driven pipeline management by analyzing deal health and flagging at-risk opportunities early, replacing biased “gut feelings” with reliable insights.

Together, these four integrated components, RevOps, a hybrid coverage model, buyer enablement, and strategic AI, form a cohesive, powerful playbook for achieving predictable, scalable growth.

The Framework in Action: Evidence of Transformation

The principles of the Hybrid GTM framework are more than ideas; they have delivered measurable, transformative results for B2B organizations willing to move beyond outdated approaches. The following cases show how a disciplined focus on alignment and execution can unlock significant growth, even in the most complex markets.

Case 1: Overhauling Go-to-Market for High Performance. An IT services provider was stagnating despite high sales activity. By revamping its operating model, using strategic customer segmentation, a rigorous sales coaching program, and aligned incentives, the company reignited its growth engine. This transformation resulted in a 20% increase in winning bid rates and drove 40% year-over-year growth in a recently acquired business unit. Over five years, this initiative was expected to add $1 billion in net present value to the company.

Case 2: Unlocking Revenue by Unifying Sales and Marketing. A B2B software firm struggled with long sales cycles and identified its main bottleneck as the deep-seated misalignment between its sales and marketing teams. By implementing joint account planning, shared data through a new RevOps team, and unified lead criteria, the company broke down these silos. The result was a pipeline of higher-quality, better-educated leads, which shortened the sales cycle by over 20% and led to a record-breaking quarter for revenue.

Case 3: Driving Growth with a Modern Hybrid Sales Model. A traditional industrial manufacturer adapted to changing buyer behavior by replacing its field-only sales force with a dynamic hybrid model. By investing in digital channels and training reps in virtual selling, the company enabled its team to cover four times as many accounts. This modern approach accelerated revenue growth faster than at any point in the last decade, showing that even in traditionally slow-moving sectors, meeting buyers where they are, both online and offline, is a powerful way to boost growth.

Case 4: Scaling Success with Sales Plays and AI. A fast-growing SaaS provider established its winning behaviors by developing a structured sales playbook and embedding it into its CRM. By enhancing this playbook with AI tools that identify at-risk deals and offer real-time coaching, the company achieved a step change in execution consistency. The percentage of reps meeting quota jumped from just 20% to over 70%, and the company’s annual revenue growth nearly doubled from around 15% to over 30%.

These diverse examples share a common theme: intentional alignment and disciplined execution are essential to unlocking growth in complex markets.

The Executive Mandate: A Blueprint for Leading Change

Implementing this new framework is fundamentally a leadership challenge. It requires a clear vision, decisive action, and unwavering commitment from the C-suite to guide the organization across the Growth Divide. The following mandates provide an actionable blueprint for leading that transformation.

Mandate 1: Focus on Productivity, Not Just Activity. Shift the organization’s focus from celebrating vanity metrics like calls and emails to measuring what truly matters: outcomes. Redefine success with KPIs such as pipeline velocity, win rates, and revenue per rep. Invest aggressively in eliminating low-value administrative tasks that drain your sellers’ time, so they can focus on high-impact, human-to-human selling.

Mandate 2: Architect a Truly Unified Commercial Team. Make breaking down silos between Sales, Marketing, and Customer Success a strategic priority. The most effective approach is establishing a formal RevOps function responsible for creating shared revenue goals, enabling joint planning, and maintaining a unified view of the customer across the organization.

Mandate 3: Segment and Prioritize Ruthlessly. Recognize you can’t serve everyone equally. Use data to identify your Ideal Customer Profile (ICP), tier your accounts, and align your coverage models accordingly. This strategic focus ensures your most valuable resources, your high-touch sellers, are dedicated to the most promising opportunities, avoiding wasted effort on low-potential segments and breaking free from the Activity Trap.

Mandate 4: Simplify the Internal Environment. Internal complexity is a hidden growth killer, leading to a poor customer experience. Simplify your internal processes by streamlining sales workflows, clarifying roles and responsibilities, and optimizing your tech stack. If a tool or process doesn’t demonstrably help your team sell more effectively, eliminate it.

Mandate 5: Invest in Continuous, Buyer-Centric Enablement. Move beyond one-time training events. Build a continuous enablement program that provides your teams with deep insights, modern content, and consultative skills to guide buyers through their complex, non-linear journey. Invest equally in buyer enablement tools as you do in sales enablement tools.

Mandate 6: Champion a Customer-Obsessed Culture. Culture drives transformation. As a leader, set the tone by fostering a culture relentlessly focused on solving customer problems. Reward behaviors that prioritize the customer, cut internal bureaucracy to deliver value swiftly, and ensure everyone understands that sustainable growth depends on making your customers successful.

The complexity of the modern B2B sales landscape is real but manageable. The companies that succeed in the next decade won’t be those in simpler markets but those who master complexity. By adopting this new playbook and executing with discipline, you’ll create a repeatable growth engine that propels your organization toward market leadership

SalesGlobe is a leading sales effectiveness and data-driven creative problem-solving firm. We specialize in helping Global 1000 companies solve their toughest growth challenges and helping them think in new ways to develop more effective solutions in the areas of sales strategy, sales organization, sales process, sales compensation, and quotas. We wrote the books on sales innovation with The Innovative Sale, What Your CEO Needs to Know About Sales Compensation, and Quotas! Design Thinking to Solve Your Biggest Sales Challenge.

Sales Strategy & Revenue Growth Consultant

Data-minded strategist helping organizations align performance, optimize sales design, and drive revenue with precision.