Why is Inflation a Big Deal for Your Customers and What Should You Do for Them?

Why is Inflation a Big Deal for Your Customers and What Should You Do for Them?

What You Need to Know

- ◆In the past four years (2020-2024), consumers and companies have absorbed about 45% of the prior 20-year inflation rate (2000-2020) in about 20% of the time.

- ◆Cumulative inflation may be impacting certain customer segments more than others with a loss in real household income.

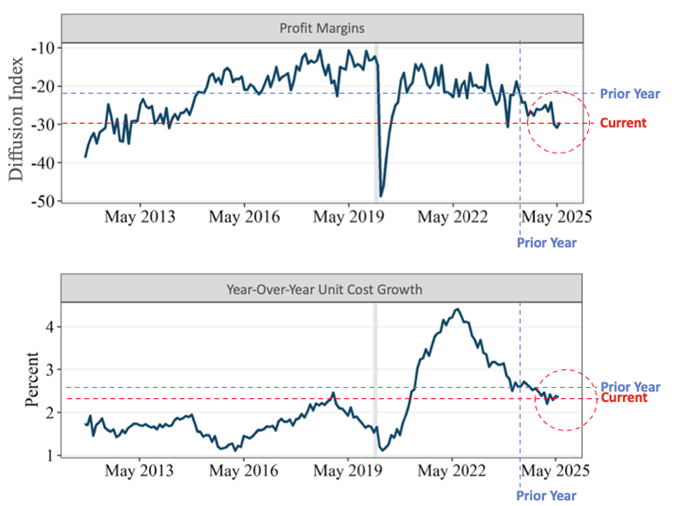

- ◆The percent of companies across industries reporting a decrease in sales and margins is greater than those reporting an increase, which is worse than prior year, but improving from prior month.

- ◆Unit cost increases have stabilized, despite looming tariffs, and have slowed slightly from prior year.

SalesGlobe Signals is about seeing a bigger, macro view on growth and taking actions that will help you reach your growth aspirations. This month let's take a reading on a few signals that may be impacting your customers, how you create value, and how you set expectations for your organization– inflation, growth and margin trends.

With this broader, macro view, our focus is on helping executives answer two questions for their businesses:

- What Are the Market Signals? Indicators you might watch for your business and what they say about what may be ahead.

- What Does This Mean for Profitable Revenue Growth? Based on the signals, how you may think about growth for your business and the actions you may consider.

![]()

Inflation– Slowing but Its Grip is Still Tight

What Are the Market Signals?

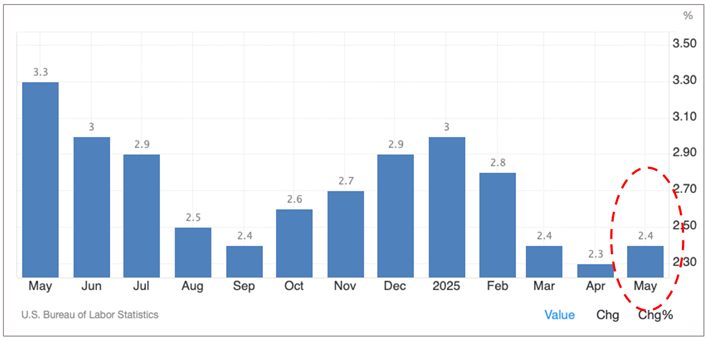

Inflation is up in May from April at 2.4% but below the 2.5% expectation and down compared to 3.3% a year earlier according to the US Consumer Price Index. Core inflation, excluding food and energy, held at 2.8% vs. expectations of an increase to 2.9%

The pressure on prices continues, although lower than the past twelve months, and anticipation of tariff impacts are still looming. While we tend to focus on near-term inflation, zooming out for a bigger picture reveals why inflation has become such an issue and what that might mean for commercial revenue growth.

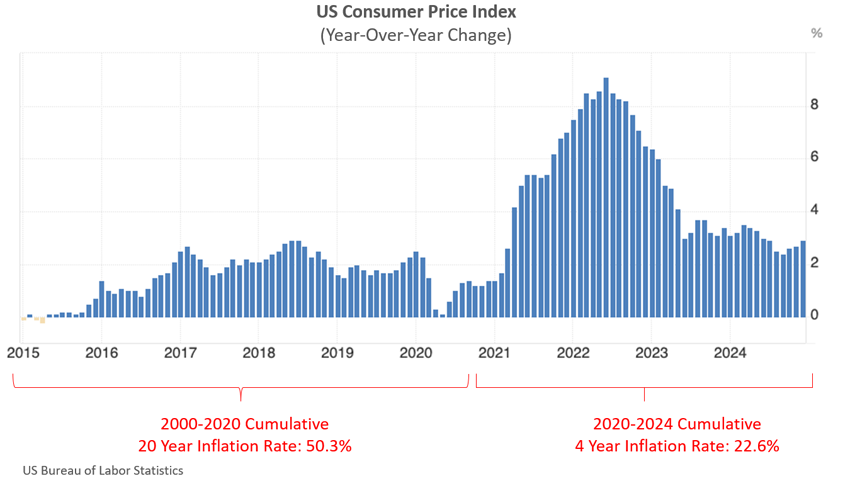

Since 2000, over a period of two decades through 2020, inflation wasn't a top-of-mind concern for most people. The US had an average annual CPI increase of about 2.1%. So, its impact on customers and purchasing power was nominal. But, of course, that 2.1% adds up through the magic of annual compounding. Let's look at the total impact.

From the year 2000 through 2020, the cumulative inflation rate was 50.3%, meaning that if you purchased something for $100 in 2000, that same item would have cost you $153 in 2020, twenty years later.

But, by comparison, from 2020 through 2024, the cumulative inflation rate was 22.6%, meaning that if you purchased something for $100 in 2020, that same item would have cost you $122 in 2024, four years later. So, the US has absorbed almost half (45%) of the prior 20-year inflation rate in just the past four years.

Comparing that level of inflation to actual household purchasing power, median US household income for the 2000 to 2020 period rose by 63.6%, giving households an inflation-adjusted increase of 15.4%, meaning that households increased their purchasing power over that period. But for the 2020 to 2024 period, household income rose only 21.4%, yielding an inflation-adjusted decrease of about -1%, reducing purchasing power.

What Does This Mean for Profitable Revenue Growth?

The bigger view on inflation shows us some pressure points on our customers and our organizations. If your company provides products or services to businesses, your customers are dealing with the stress of increased input costs due to inflation and the anticipation or realization of tariffs. Some of your business customers may have been able to increase their top line or find cost savings in other areas to maintain their margins. If your customers are consumers, they're likely feeling the stress of costs outpacing income, particularly if they are at household income levels or fixed incomes that make it difficult to absorb those cost increases.

Your organization may also be impacted by the gradually tightening effects of inflation. Some employee groups may have financial pressure which, if pay packages are no longer market-competitive, can lead to an increase in turnover. Other employee groups may be able to drive increased performance, such as sales which typically carries a large portion of earnings in performance pay.

To set your direction, here are some questions you may ask your organization:

- Do we have segments that are impacted by inflation differently and are some less-impacted by inflation?

- Should we shift our focus on customer segments to target those less-impacted by overall costs increases (e.g., If B to B, perhaps businesses that have maintained margins. If B to C, perhaps consumers with income levels and discretionary income that align with our offers)?

- Can we improve our price position to address segments that are most impacted by increasing costs?

- Can we sharpen or improve our value proposition or overall product or offer value relative to our pricing?

- How can we make sure our pay plans are competitive, while operating within our labor cost or compensation cost of sales parameters?

- Have our quotas kept pace with inflation, and have we maintained or improved real productivity levels over the past five years or just kept pace or fallen behind?

- How can we set attainable revenue and profit goals, for performance pay, that align to the overall business goals?

Sales and Profit– Trending Down but Stabilizing

What Are the Market Signals?

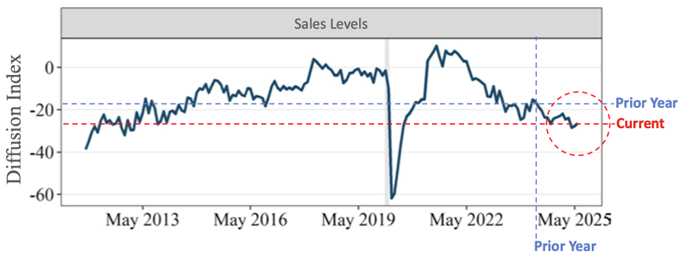

For companies across industries, sales levels have stabilized vs. prior month but are still down about 30% year-over-year on the diffusion index1 of net percent of companies reporting an increase or decrease in sales from prior month. This is according to the Federal Reserve's 6th District Business Inflation Expectations Panel (BIE) of which SalesGlobe is a contributing member.2

Profit margins follow a similar pattern of being down from one year ago, but more so at about a 36% decrease on the diffusion index. However, during the same period, unit costs have not grown at the same rate but have decreased about 13% from prior year. So, contrary to what we might expect, cost does not appear to be the contributing factor to the larger portion of companies reporting decreases in sales and margins than increases.

What Does This Mean for Profitable Revenue Growth?

This downward trend in sales and margins over the past year, with a less significant trend in unit cost growth may indicate that your customers' sales and margins are impacted by pricing pressure which is decreasing revenue growth or eroding margins. If they have a significant portion of their revenue from major accounts or deal with strong-armed procurement organizations, your customers may be increasing their discounts to those customers to protect or retain their business.

Your customers may also be shifting product mix to lower margin products to counter their customers' inflation-driven pressures. Finally, your customers may be dealing with higher overhead, SG&A, or distribution costs, again potentially driven by inflation or tariffs.

From the perspective of your organization, you may think about how your strategy, offers, and go-to-market approach with your sales organization can address your customers' challenges. These will, of course, vary by industry and customer type. For a more industry-specific read, you can contact us at info@salesglobe.com.

To set your direction, here are some questions you may ask your organization:

- What do revenue, margin, and cost trends look like for each of our target customer segments?

- How can we heat map those segments to find the healthiest areas for growth potential or areas with the greatest needs we can address with our offers?

- Given our products and services, how can we help our customers better serve their end-users if they are dealing with pricing and discounting pressures?

- If our customers incorporate our offers in their products and services, how can we work with them to create higher margin or more competitively priced offers for their end-users?

- With what we offer now, how can we help our customers lower their SG&A or overhead costs?

- Are there services we can offer beyond what we traditionally think of as our core products that would help our customers reduce their costs?

- How can we partner with another organization in an adjacent space to create a better offer for our customers or for our customers to offer to their end-users?

![]()

Your Call to Action

Look at each of the signals we've discussed around inflation, revenue, and profit margin trend. Next, check the signals for unit cost, tariff, and price passthrough expectations as I described in our June issue. Then, consider their impact from two perspectives: How will they affect your customers and their ability to grow? How will they affect your business? Get beyond current state and ask your team where they see the signals projecting ahead and what this means for your organization's profitable growth. Consider each of the questions I've asked, add your own, create a plan, and get into action. Questions for us? Email us at info@salesglobe.com or contact us at SalesGlobe.com.

1The Diffusion Index is the percent of companies reporting and increase in the metric, minus the percent reporting a decrease in the metric. Therefore, it is a measure of direction, not magnitude. A positive value indicates more companies reported increases in sales. A negative value indicates more companies reported decreases in sales.

22Atlanta Fed Business Inflation Expectations Panel (BIE) 6th District, SalesGlobe Member. Approximately 700 Companies Across Industries. BIE results are highly correlated with other macro market surveys including the Federal Reserve Economic Data GDP Price Index, the Philadelphia Fed Survey of Professional Forecasters, and the University of Michigan Survey of Consumers. May 2025.

![]()

SalesGlobe is a revenue growth consulting and services firm focused on helping our clients reach their growth aspirations through better solution-development and operationalizing to get results. We specialize in helping Global 1000 companies solve their toughest growth challenges and helping them think in new ways to develop more effective solutions in the areas of sales strategy, sales organization, sales process, sales compensation, and quotas. We wrote the books on sales innovation with The Innovative Sale, What Your CEO Needs to Know About Sales Compensation, and Quotas! Design Thinking to Solve Your Biggest Sales Challenge.

Founder and Managing Partner at SalesGlobe

“We help companies solve tough sales challenges to connect their sales strategies to the bottom line.”