Layoffs: Strategy or Expense Management

The corporate world has seen numerous layoffs announced from 2022 through 2025. Big Tech, in particular, laid off tens of thousands of workers, reversing the massive hiring sprees of the pandemic period. This wave of layoffs has left employees, investors, and analysts questioning: Are these cuts a sign of disciplined leadership correcting overexpansion, or are they a short-term fix for deeper, unaddressed problems?

The answer lies in a key difference that separates reactive cost-cutting from proactive strategic transformation. While both may involve reducing headcount, one is a defensive move and the other a act of reinvention. Layoffs as a simple expense-management tool often lead to a quick financial boost followed by a long-term cultural hangover. In contrast, layoffs carried out as part of a broader strategic overhaul can set a company on a new path toward sustainable growth.

The main lessons from companies that followed these two different paths are highlighted. By studying their financial, operational, and cultural results, and the leadership stories behind them, a clear pattern appears, showing what distinguishes a simple cut from a genuine corporate reset.

The “Sugar Rush” of Layoffs Hides a Long-Term Cost

For many companies, announcing layoffs provides an immediate boost of market approval, a sugar rush of investor confidence. However, when layoffs are not linked to a clear strategic shift, this short-term financial gain often sacrifices long-term cultural and operational health.

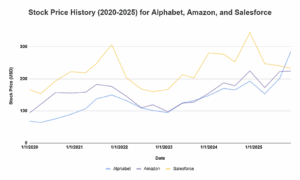

Companies like Google, Amazon, and Salesforce exemplify this pattern perfectly. After announcing significant job cuts, they were quickly rewarded by Wall Street. Alphabet’s shares rose nearly 50% over the year following its cuts. After returning to profitability, Amazon’s stock more than doubled from its 2022 lows. Similarly, after posting record profit margins, with its operating margin reaching 33% under pressure from activist investors, Salesforce’s stock increased by more than 50% in the first half of 2023.

posting record profit margins, with its operating margin reaching 33% under pressure from activist investors, Salesforce’s stock increased by more than 50% in the first half of 2023.

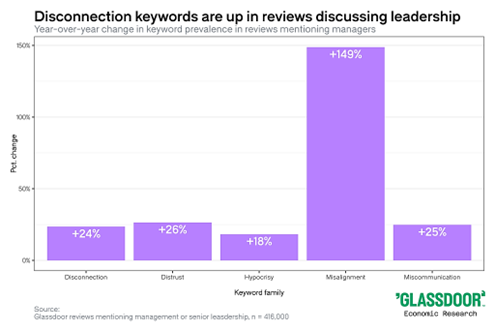

These gains were driven by cost savings, not by new growth strategies. Amazon cut back on “underperforming bets” and “experimental projects,” while others focused on broad-based efficiency. While investors cheered the renewed financial discipline, the internal cost was high. At Google, its reputation as a “career destination” took a hit. At Amazon, “job security faded, even for top performers,” leaving teams feeling “more transactional.” At Salesforce, there was a “sharp break” as its well-known “‘family’ ethos” shifted toward a new focus on performance. The cuts addressed over-hiring but left a lingering sense of uncertainty once the initial financial high faded.

Smart Companies Don’t Just Cut, They Reinvent

In stark contrast to companies that focus solely on managing expenses, a few firms used workforce reductions as a catalyst for a major strategic shift. They didn’t just cut costs; they reinvented their business models.

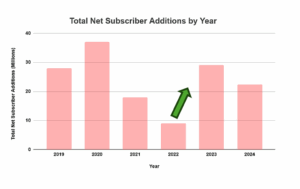

Netflix exemplifies this approach. After experiencing its first subscriber loss in ten years, the company responded with targeted layoffs as part of a clear shift to new revenue streams. It launched an ad-supported tier and cracked down on password sharing, two moves that reignited growth and added over 30 million new subscribers in 2023. These cuts sharpened the organization’s focus on these new priorities.

Similarly, when Bob Iger returned to Disney, the announced 7,000 layoffs were part of a large restructuring effort aimed at saving $5.5 billion and restoring profitability to its streaming division, which was losing more than $1 billion each quarter. He planned to “put creativity back at the center” by undoing a centralized structure and empowering creative leaders with “real authority” and P&L ownership. He reorganized the company into three main segments, Entertainment, ESPN, and Parks, to improve accountability.

Ford offers another clear example from the manufacturing sector. Its 3,000 layoffs were directly linked to a goal of saving $3 billion annually to fund its transformation into an electric vehicle leader. The company was fundamentally split into “Model e” (for EVs) and “Ford Blue” (for traditional vehicles), with the layoffs intended to streamline the legacy business and support the new one.

In each case, these cuts enabled the company to pursue a new direction, paving the way for sustainable recovery and growth.

The Leadership Story Is as Important as the Layoffs

The outcome of a layoff is deeply influenced by the narrative leaders craft around it. The story told to employees and investors can determine whether a company is seen as struggling or as executing a clear plan.

Two distinct narratives appeared from the recent layoffs.

- Defensive: Leaders at companies like Google and Salesforce accepted responsibility for “over-hiring” during the pandemic boom. While truthful, this explanation “focuses on past mistakes rather than a future vision,” and offers little to boost confidence beyond short-term cost savings.

- Proactive and Strategic: Leaders like Bob Iger at Disney and Jim Farley at Ford directly linked their workforce cuts to a concrete plan for future growth. Iger described the cuts as a way to make the company more agile and profitable in streaming, while Farley saw them as a necessary move to support Ford’s shift to electric vehicles. A well-defined, forward-looking plan gives both investors and remaining employees something to believe in, helping to rebuild confidence and purpose amid change.

When leadership shares a clear plan, stakeholders are more likely to stay engaged and hopeful. Disney’s example highlights how tying tough choices to long-term value can help navigate challenging times.

Investors Are Getting Smarter About Layoffs

While investors have always welcomed lean operations, they are now looking beyond the headline numbers of a layoff announcement. The market is becoming more sophisticated, distinguishing between simple cost-cutting and a genuine strategic reset.

Investors now seek a clear strategy for profitable growth linked to the cuts. The positive response to Disney’s restructuring demonstrates this shift; as the source notes, “investors saw the strategy behind the move.” They weren’t just reacting to the $5.5 billion in savings but to the credible plan to overhaul the streaming business and restore accountability to creative leaders. As the source material insightfully remarks, “Often, investors prefer a bold plan with risk over no plan at all.”

Research confirms this trend, showing that layoffs aimed solely at achieving short-term profits rarely create lasting shareholder value. Leaders who can present workforce changes as a vital part of a broader, credible strategy for the future are much more likely to gain the market’s long-term confidence.

It’s a Tool, Not a Strategy

Ultimately, the key lesson from the 2022-2025 layoff cycle is that workforce reductions are a tool, not a strategy in themselves. On their own, layoffs rarely solve a company’s fundamental problems. They are a “temporary fix, not a lasting solution.”

When used solely to cut costs, layoffs can trigger a vicious cycle. Many tech firms that cut in 2022 without a strategic shift “had to cut again in 2023, creating a cycle of disruption” and damaging morale. In contrast, companies that combined cuts with a comprehensive business redesign, like Disney and Ford, “aimed to do it once and move forward.” They saw the difficult decision as part of a single, decisive reset.

Layoffs should be one element of a broader plan for change, growth, and reinvention. Without that bigger picture, they are just an accounting move. With it, they can become a catalyst for building a stronger, more resilient organization.

The difference is simple: cutting costs alone boosts the next quarter, while cutting costs and reinventing the business prepares the organization for the next decade.

The Real Question to Ask

The recent wave of corporate restructuring has highlighted a clear divide between two fundamentally different strategies: reactive cost-cutting and proactive, strategic realignment. While they may seem similar on the surface, their long-term effects on a company’s health, culture, and market position are vastly different.

How leaders handle these challenging transitions, with a clear vision, open communication, and respect for their employees, ultimately determines their company’s future. It distinguishes those who are simply weathering a downturn from those who are shaping the next version of their business.

The next time a major company announces layoffs, don’t just ask how many jobs were eliminated. Ask what they plan to create in their place.

![]()

SalesGlobe is a leading sales effectiveness and data-driven creative problem-solving firm. We specialize in helping Global 1000 companies solve their toughest growth challenges and helping them think in new ways to develop more effective solutions in the areas of sales strategy, sales organization, sales process, sales compensation, and quotas. We wrote the books on sales innovation with The Innovative Sale, What Your CEO Needs to Know About Sales Compensation, and Quotas! Design Thinking to Solve Your Biggest Sales Challenge.

Sales Strategy & Revenue Growth Consultant

Data-minded strategist helping organizations align performance, optimize sales design, and drive revenue with precision.