Why 2026 Demands a Different B2B Sales Strategy

Macroeconomic Headwinds Through 2025–2026

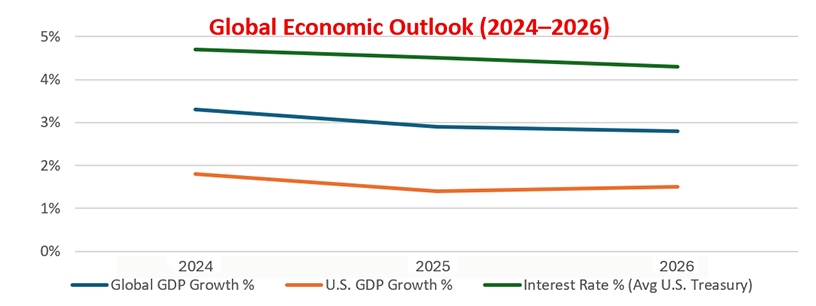

B2B leaders are confronting an economic environment in 2025–2026 that is notably less favorable than recent years. Global growth is expected to slow significantly, with Morgan Stanley predicting only 2.9% growth in world GDP in 2025 and 2.8% in 2026, down from about 3.3% in 2024. 2025 is likely to see the slowest global growth since the pandemic’s trough. Likewise, the U.S. economy is expected to exhibit modest expansion, with Deloitte estimating U.S. GDP growth at 1.4% in 2025 and 1.5% in 2026. These subdued growth rates, along with persistently high interest rates and policy uncertainties, are weakening business investment and hiring. For example, U.S. 10-year Treasury yields are expected to remain elevated at around 4.5% into late 2025, gradually easing afterwards. As a result, capital costs will stay high, impacting expected returns on sales and marketing investments.

Although inflation is easing from its peak, it is not offering significant relief. Continued trade conflicts have added new price pressures, with a series of U.S. tariffs expected in 2025 that will likely cause an “abrupt increase in tariffs and related uncertainty.” The IMF has warned that this situation will slow global growth and temporarily boost inflation in the affected markets. In this environment, businesses face volatile input costs and currency fluctuations. All these factors create a tougher environment for B2B sales: clients have more constrained budgets, finance teams are scrutinizing expenses, and sales forecasts have become less dependable. In short, slower growth, higher capital costs, and increased market volatility are shaping the B2B selling landscape as we move into 2026.

Organizations are recognizing the need to adjust their strategies in response to these challenges, as assuming that the market conditions of a few years ago will persist could result in costly errors. An analyst noted that the global economy is entering a “new era” of uncertainty, characterized by trade tensions and unpredictable policies that can rapidly tighten financial conditions and shift demand trends. To succeed, B2B teams must create contingency plans for various economic scenarios instead of depending on a single macroeconomic forecast.

Executive Planning: Caution and Scenario Thinking

With the economic outlook remaining uncertain, business leaders are significantly adjusting their planning and resource allocation strategies – a trend that B2B sales leaders need to watch closely. In 2025, waning business confidence has resulted in more cautious planning cycles. A JPMorgan survey of middle-market firms conducted mid-2025 showed that optimism about the U.S. economy dropped to 32%, down from 65% at the start of the year. Consequently, 25% of these leaders now foresee a recession in 2025, a notable rise from just 8% earlier in the year.

This decrease in optimism leads many companies to delay or alter their strategic plans. A JPMorgan poll found that 44% of executives have postponed parts of their business strategies due to external uncertainties. The main reasons for this hesitation include policy uncertainty (74%), market volatility (37%), changing customer demand (37%), and geopolitical issues (35%). In essence, when the external environment becomes unpredictable, with fluctuating tariffs, interest rates, and customer needs, executives tend to avoid committing to long-term investments. Instead, they are increasingly using scenario planning and agility in their strategic approaches.

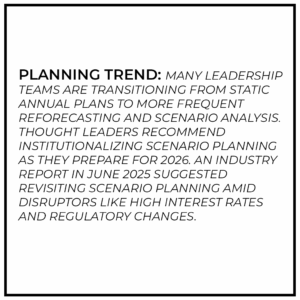

Unlike traditional strategic planning, which follows a single predetermined course, scenario planning encourages leaders to explore “what if…?” questions, such as: What if inflation spikes? What if a major market enters a recession? This method recognizes the risks of sticking rigidly to a fixed plan in an uncertain environment. As a result, executives are adopting shorter planning cycles, typically ranging from 6 to 8 months, and making their strategies more flexible and iterative. The goal is to stay adaptable: as new information, like rate hikes or supply shocks, arises, plans can be revised instead of abandoned.

2026 will favor B2B sales approaches that are adaptable and based on scenario planning. CEOs and CFOs are unlikely to make major commitments based on a single forecast. Sales leaders should expect more frequent adjustments from the C-suite and tailor their sales strategies to various possible economic scenarios.

B2B Buyer Behavior Is Evolving

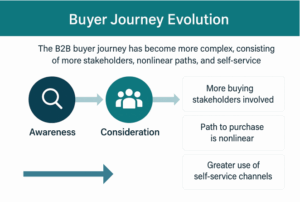

As executives revise their strategies, B2B customers are also shifting their purchasing behaviors, a trend expected to intensify moving forward. For sales strategies in 2026 to succeed, they must account for the changing preferences and buying methods of modern B2B buyers, who have undergone considerable evolution over the last decade. Key trends are emerging and should be followed closely.

Longer, More Complex Purchase Cycles

B2B sales cycles are increasingly lengthy and complex due to heightened scrutiny. Data indicates that the average B2B buying process now lasts about 11-12 months, with complex multinational deals taking up to 16 months to close. Over 80% of enterprise tech buyers are segmenting their buying process into phased steps to ensure they only commit to mission-critical purchases. Additionally, 87% report tightening their purchasing criteria to focus on essential products given current market conditions. This cautious approach necessitates a more nurtured sales pipeline; sellers should anticipate longer evaluation times and stalls. Forrester’s research indicates that approximately 86% of B2B purchases encounter stalls before final decisions are made. The era of quick-closes is largely gone, as customers now emphasize internal consensus and risk reduction.

B2B sales cycles are increasingly lengthy and complex due to heightened scrutiny. Data indicates that the average B2B buying process now lasts about 11-12 months, with complex multinational deals taking up to 16 months to close. Over 80% of enterprise tech buyers are segmenting their buying process into phased steps to ensure they only commit to mission-critical purchases. Additionally, 87% report tightening their purchasing criteria to focus on essential products given current market conditions. This cautious approach necessitates a more nurtured sales pipeline; sellers should anticipate longer evaluation times and stalls. Forrester’s research indicates that approximately 86% of B2B purchases encounter stalls before final decisions are made. The era of quick-closes is largely gone, as customers now emphasize internal consensus and risk reduction.

More Stakeholders Involved in Every Deal

The era of a single decision-maker has ended. Gartner research shows that a typical complex B2B solution purchase now involves 6 to 10 decision-makers, each with their own studies and priorities. Buying committees have grown in size and seniority, with one study noting the average group has 10-11 members, and even more for global deals, often including C-suite executives like the CFO. In fact, the CFO holds final approval in 79% of B2B deals. This larger group slows decision-making and makes consensus harder. Sales teams need to become skilled at navigating organizational politics and addressing diverse concerns. They should also identify internal champions early and empower them to advocate internally, since external sales increasingly depend on securing buy-in from within the organization.

Digital-First and Self-Service Preferences

A shift is happening among B2B buyers, who are becoming younger and more comfortable with digital technology. Millennials and Gen Z now make up over half of B2B purchasers, expecting a shopping experience similar to B2C, which is easy, quick, and digital. Understandably, most B2B buyers prefer to do online research independently before reaching out to a salesperson. Gartner found that 77% of B2B buyers considered their last purchase very complex or difficult, mainly because they try to handle the complexity through self-education. It is estimated that 70-80% of the B2B buying process happens before the buyer contacts a sales rep.

Moreover, three out of four B2B buyers favor a no-rep experience. This shift has significant consequences for 2026: organizations must enhance their digital channels, such as content marketing, websites, and marketplaces, as buyers increasingly seek information online rather than relying on sales representatives. Experts forecast that by 2027, 80% of interactions between B2B buyers and suppliers will happen via digital means, such as online self-service or remote engagement. Furthermore, as younger buyers gain influence, more large B2B transactions are expected to be managed through digital self-service platforms. Therefore, a sales strategy for 2026 should include strong digital sales capabilities. Sales reps’ roles will shift toward offering complex consulting, with less emphasis on simple order processing, which customers can manage independently.

Greater Influence of External Sources

B2B buyers now utilize broad information networks that extend beyond vendor content. They seek input from industry peers, third-party analysts, social media, and consultants. Forrester reports that in 2025, over half of younger buyers will incorporate at least 10 external influencers, like social media contacts, consultants, or user communities, into their decision-making process. Additionally, nearly 72% of buying teams enlist outside consultants or analysts for important purchases. Hence, buyers come to the table with insights beyond the sales team’s control. A sales strategy in 2026 should consider these influences by offering case studies and ROI data for internal sharing and maintaining credibility with independent industry experts who shape buyer opinions.

Bottom Line

The B2B buyer’s journey has expanded in length, become increasingly digital, and involves a greater number of stakeholders. By 2026, sellers will need to connect with buyers on their preferred terms, mainly via remote and digital channels, and assist in simplifying the buying process. Sales teams that enable buyer self-service for simple tasks and act as expert advisors for more complex challenges will foster trust and achieve success.

Go-To-Market Model Stress Points

Amid macroeconomic changes and shifts in buyer behavior, many companies are finding that their traditional go-to-market models are under strain. The way sales organizations are structured, including roles, channels, and compensation, often reflects a pre-COVID world and does not align with today’s realities. Several common structural issues have emerged:

High Cost-to-Serve with Legacy Sales Models

In tight-budget environments, companies are carefully evaluating their sales return on investment. Traditional field sales, which involve costly travel and long on-site visits, may be excessive for smaller deals or accounts. Many organizations have found that their cost-to-serve is inefficient, particularly when high-cost resources are allocated to low-revenue customers. A McKinsey study revealed that by using digital channels and inside sales, top companies could assign their “best field-sales expertise” to lower-cost channels, making smaller customers profitable. Essentially, forward-thinking organizations are rethinking how salespeople allocate their time, as simpler sales and smaller accounts are increasingly handled through inside sales, e-commerce, or hybrid models.

Meanwhile, expensive field visits are saved for the most important and complex opportunities. This shift is crucial for 2026 amid substantial B2B cost pressures: Forrester’s 2024 surveys show only about one-third of B2B marketing and sales leaders expect budget increases above 5% for 2025. Most teams need to achieve more with flat or shrinking resources, making outdated GTM models, where every account has a field rep or where reps spend excessive time traveling for routine demos, unsustainable. Companies clinging to these models risk margin erosion, as selling costs fall and revenue growth stalls.

Misalignment between Sales, Marketing, and Customer Success

Another structural issue is the siloed setup of many B2B sales and marketing teams. Traditionally, marketing would generate leads and pass them to sales, while customer success teams operated separately post-sale. This linear handoff is inadequate as buyers follow a non-linear path. Gartner states that the traditional sequential process, where marketing nurtures leads before transferring them to sales, is outdated in today’s complex buying environment. Customers don’t transition smoothly from marketing content to sales calls; instead, they research and re-engage at various stages, bouncing back and forth. This creates visible gaps or conflicts between marketing and sales to the customer. Many organizations continue to struggle with aligning sales and marketing efforts and delivering a consistent message. A Forrester 2025 forecast indicates that only 12% of marketing leaders believe their current organizational structure effectively supports revenue growth, leading many companies to consider reorganizations. Common issues include marketing passing low-quality leads to sales, inconsistent sales messaging, and a lack of coordinated outreach.

Pre-sales engineers, account executives, and post-sale customer success managers often have different incentives, which can create gaps between promises made and what is actually delivered. This misalignment can lead to increased churn if promises aren’t kept and lower win rates if internal teams aren’t coordinated during long sales processes. By 2026, successful companies aim to address these issues; some are forming “revenue operations” teams that include both marketing and sales, while others use shared data and KPIs to ensure accountability across teams. The main trend is moving towards a comprehensive approach to the entire buyer journey, rather than simply handing off responsibilities from one team to another.

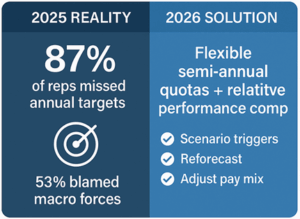

Sales Compensation and Quota Challenges

Sales incentives that worked well in the pre-COVID era can become counterproductive during volatile periods. Many B2B companies set annual quotas and commission plans, assuming continuous growth. However, as seen in 2025, these assumptions can be quickly disrupted by factors such as interest rate spikes or changes in trade policy. A recent Xactly report shows that 87% of sales teams struggled to meet their quotas in 2025, with 53% citing external economic conditions as the leading cause. This underscores a key risk: when markets change, fixed quotas and pay structures can demotivate teams and lead to the misallocation of effort. For example, if an economic slowdown affects a region, salespeople there may struggle to meet their rigid annual goals, which can harm morale and lead to increased turnover. Indeed, sales leaders report higher burnout and turnover as reps chase unrealistic targets. Flaws in compensation models also influence behavior; rigid structures that only reward closed deals may discourage patience for longer sales cycles or teamwork needed for complex deals. Leading companies are addressing these issues by introducing more flexibility in quota setting and pay plans, such as shifting to semi-annual quotas to reflect current market conditions better.

Evidence of GTM Redesigns and Pivots

Many forward-thinking companies are actively adapting their go-to-market models to meet upcoming challenges. Analyzing these real-world responses can help us envision what a “different” B2B sales strategy might resemble in 2026.

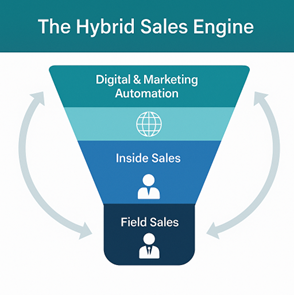

Rise of Hybrid and Inside Sales

Organizations are transitioning their sales teams from exclusively field-based roles to hybrid (combining remote and in-person work) roles and inside sales. According to McKinsey’s Global B2B Pulse data, roles involving hybrid and digital sales have been the fastest-growing in recent years, significantly surpassing the expansion of traditional field sales positions. Companies adopting hybrid models report notable advantages, including increased customer contact, quicker response times, and reduced travel expenses. For example, a financial services company increased its hybrid sales reps by 50% and invested in technology to enable virtual selling. This led to about 10% higher top-line growth and improved consistency in customer messaging. The key lesson for 2026 is that a successful sales strategy will likely blend digital touchpoints with human expertise, using the appropriate method for each situation. Routine meetings can happen via Zoom or self-serve portals, while important negotiations or workshops still benefit from in-person meetings. This hybrid model cuts costs and meets customer preferences, as many customers appreciate the efficiency of virtual interactions.

to McKinsey’s Global B2B Pulse data, roles involving hybrid and digital sales have been the fastest-growing in recent years, significantly surpassing the expansion of traditional field sales positions. Companies adopting hybrid models report notable advantages, including increased customer contact, quicker response times, and reduced travel expenses. For example, a financial services company increased its hybrid sales reps by 50% and invested in technology to enable virtual selling. This led to about 10% higher top-line growth and improved consistency in customer messaging. The key lesson for 2026 is that a successful sales strategy will likely blend digital touchpoints with human expertise, using the appropriate method for each situation. Routine meetings can happen via Zoom or self-serve portals, while important negotiations or workshops still benefit from in-person meetings. This hybrid model cuts costs and meets customer preferences, as many customers appreciate the efficiency of virtual interactions.

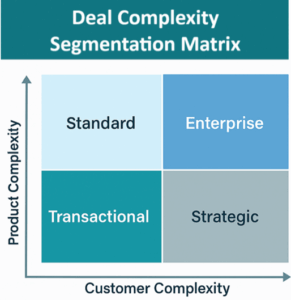

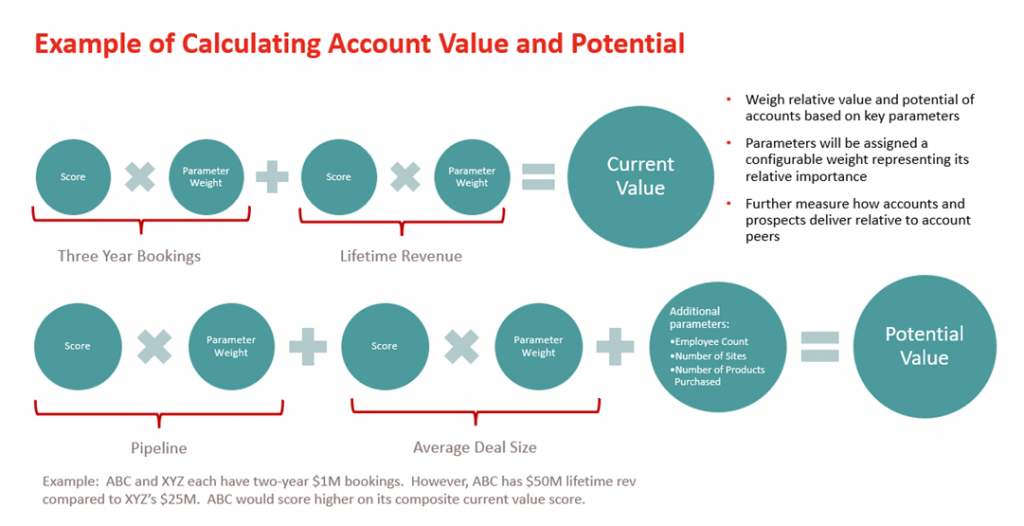

Segmenting Sales Approaches by Complexity, Not Just Size

Traditionally, large accounts were handled by field representatives, while small accounts relied on call centers. However, companies are learning that a one-size-fits-all strategy often misses opportunities and wastes resources. A more refined approach is to align the sales channel with the deal’s complexity rather than just the account size. For example, a global SaaS provider recently changed its sales approach so that the nature of the transaction – what is sold and to whom – determines the go-to-market strategy, rather than automatically assigning big accounts to field reps and smaller ones to inside sales. Consequently, simpler sales, even with large enterprise clients, are managed through inside or digital channels, while more complex, consultative deals, regardless of client size, are handled by field teams. This flexibility allows high-value sales to receive expert attention where it matters most, while less demanding transactions are managed through lower-touch channels. The result is a scalable model: customers get a personalized sales experience, and vendors efficiently allocate resources, improving cost-to-serve and productivity

Expect more companies to adopt this approach by 2026, intelligently directing opportunities to the most appropriate channel, such as e-commerce for repeat orders, inside sales for standard deals, or field teams for customized solutions. Supporting this shift typically requires enhanced insights into deal complexity and sales capacity, prompting many firms to invest in sales analytics and AI to prioritize leads and accounts more effectively.

Organizational Convergence of Sales and Marketing

As traditional marketing-to-sales funnels face disruptions, some companies are reorganizing their teams to close the gap between marketing and sales. The rise of roles like CRO, overseeing both areas, signals this shift. Additionally, cross-functional “pods” or “squads” combine marketing and sales staff to work together on duplicate accounts or segments. With only 12% of marketing leaders expressing confidence that their organizational structures meet revenue targets (per Forrester), it’s anticipated that at least half of B2B companies will reorganize in 2025 to tackle growth challenges.

roles like CRO, overseeing both areas, signals this shift. Additionally, cross-functional “pods” or “squads” combine marketing and sales staff to work together on duplicate accounts or segments. With only 12% of marketing leaders expressing confidence that their organizational structures meet revenue targets (per Forrester), it’s anticipated that at least half of B2B companies will reorganize in 2025 to tackle growth challenges.

Nevertheless, Forrester warns that many efforts may only address surface issues, such as reshuffling organizational charts, rather than the deeper cultural and procedural alignment problems. By 2026, successful firms will genuinely integrate the customer journey, employing shared KPI targets based on pipeline and revenue, a unified technology stack, and data for consistent customer insights, as well as seamless content and messaging from digital channels to sales dialogues. A Harvard Business Review article bluntly states that “traditional B2B sales and marketing are becoming obsolete,” advocating for fully unified revenue teams that are truly integrated. Evidence of this shift includes SaaS firms enabling product-led growth through close collaboration among marketing, product, and sales to boost usage, and manufacturers building inside sales units that operate between marketing and field sales to nurture leads continuously. Organizational barriers are gradually falling.

Embracing Sales Technology and AI, with Caution

Many go-to-market pivots also focus on using technology to boost sales. Recently, there’s been a rise in investments in sales tech, from CRM upgrades to AI-driven guided selling. Companies that implement these tools seek to improve seller productivity and operational efficiency.

The Risk of Rigid Plans in Uncertain Times

All these points highlight a central idea: strategic agility is essential for survival in today’s environment, not just a buzzword. A significant mistake a B2B sales organization might make in 2026 is adhering to a rigid, long-term plan as if the future were predictable. In truth, market conditions in 2025 and 2026 are highly unpredictable, and adhering to a fixed strategy could lead to serious consequences.

Review sales targets and resource plans regularly. Many companies set their 2025 sales goals in late 2024 based on specific economic conditions. However, only a few months into 2025, those assumptions started to break down, sales cycles lengthened, budgets were frozen, and trade policy changes created unexpected hurdles. Sales operations experts noticed that full-year quotas based on stable assumptions quickly became misaligned with actual developments. Companies that didn’t adjust early faced issues like falling behind targets, declining morale, and pipeline shortages. An analysis on LinkedIn by incentive consultants warned that fixed annual quotas could “set teams up for failure” if not revisited during major changes such as new tariffs or economic shocks. Rigid plans can act like a straitjacket, preventing timely adjustments. It’s better to include triggers for re-forecasting and flexible budgeting. Some organizations now plan for multiple scenarios, including a base case and a worst-case scenario, and predefine how to adjust sales hiring, marketing spend, or quotas if certain thresholds, such as GDP growth below 1% or pipeline coverage under 3x, are reached.

Flexibility in product and go-to-market strategies is essential beyond quotas. Relying solely on a single product line or customer segment can be risky if that area suddenly shrinks. In 2025, sectors heavily reliant on government or capital-intensive spending faced unpredictable demand due to fluctuating policies and interest rates. The most successful companies were those that had multiple options; for example, they could shift focus to different verticals or change their messaging from “growth” to “cost savings” when customers adopted a more cautious stance. Overcommitting resources to one area is dangerous, especially since market conditions can shift quickly, often on a quarterly basis.

Executives understand the importance of adaptability. Scenario planning helps avoid putting all resources into one approach. LIMRA advised insurers in 2025 to remain vigilant about uncertainties and respond thoughtfully as situations evolve, viewing plans as dynamic rather than fixed. Successful companies will have contingency strategies, such as a playbook for a severe downturn, which may focus on retaining existing clients and adjusting compensation to encourage renewals. They will also have another strategy for unexpected growth, such as scaling up hiring in strategic markets.

2026 has been characterized by uncertainty. B2B sales leaders should avoid sticking to a rigid strategic plan and instead focus on fostering adaptability within their teams. This may involve conducting quarterly strategy reviews, reallocating budgets flexibly, and enabling field leaders to make adjustments in real-time. Data clearly shows the risks of ignoring this approach: with 87% of sales teams struggling to meet their targets, it’s evident that the environment has changed, and many strategies have not kept up. The consequences go beyond missed targets; they include missed opportunities, such as under-investing in high-growth areas, or wasted efforts, like continuing to pursue a stalled market. The key solution is agility, which effectively addresses these issues.

Synthesis: Towards a 2026-Ready Sales Strategy

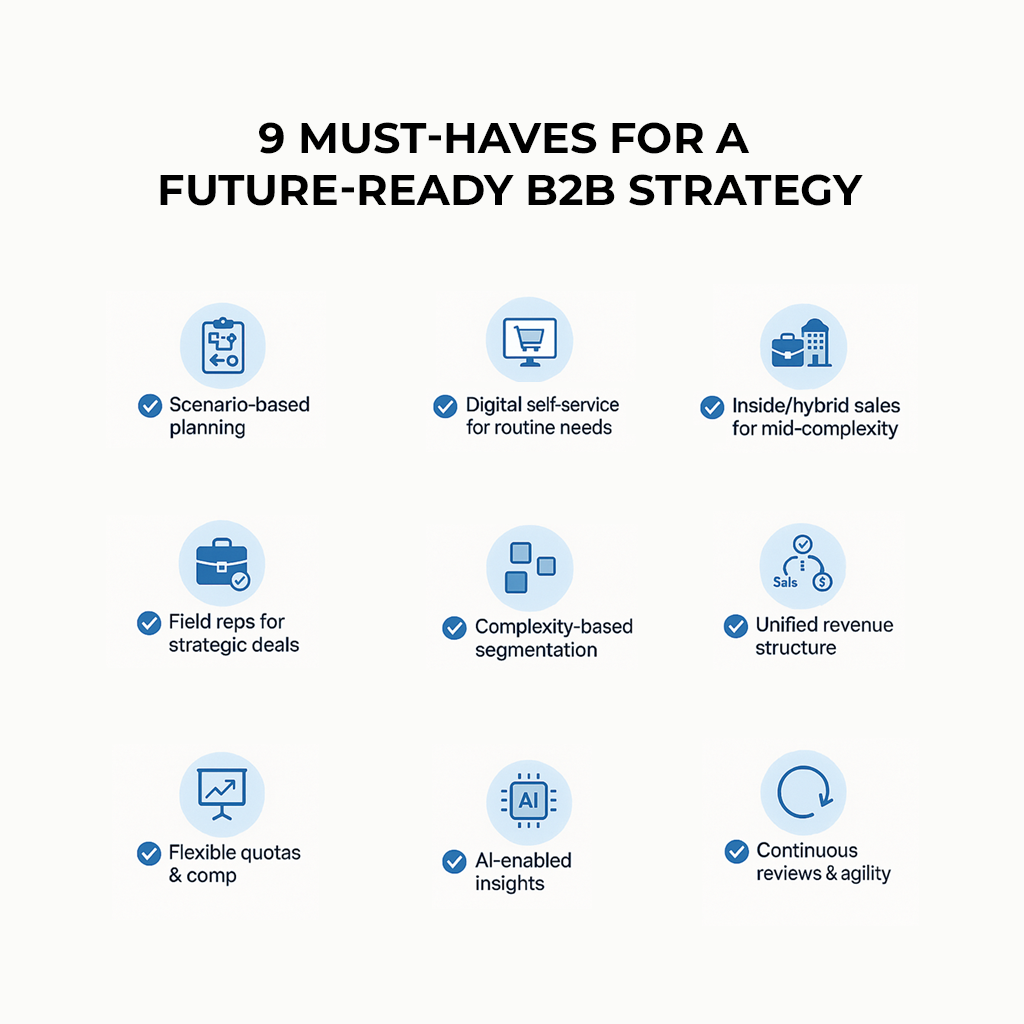

Integrating these insights, it’s evident that the 2026 B2B sales strategy must differ significantly from today’s approach. The macroeconomic environment calls for caution and adaptability, while changing buyer behaviors favor a digital, customer-focused strategy. Additionally, the internal go-to-market model needs a rethink regarding team structure and incentives. Here are essential points for a 2026-ready strategy, grounded in current trends and research.

- Adopt scenario-based planning instead of fixed annual plans. Implement flexible forecasting cycles that allow you to adjust sales strategies if GDP, interest rates, or customer demand deviate from forecasts. In volatile markets,

flexibility is more important than certainty. Recognize uncertainties and adapt your preparations. - Engage customers on their terms by aligning your sales approach with modern B2B buying behaviors, which are becoming more digital, collaborative, and step-by-step. Focus on content and digital self-service for the 80% of interactions happening online. Equip your sales team to serve as advisors and facilitators during the 20% of interactions where personal involvement is valuable. Simplify the buying process to help customers navigate internal complexity; act as a guide capable of navigating a 10-person buying committee and addressing common delays.

- Optimize your cost-to-serve by reassessing which sales activities genuinely need high-touch, costly efforts. Many companies have shown that shifting simpler sales to inside sales teams or e-commerce channels can sustain revenue while lowering expenses. Use your field team for strategic deals where face-to-face engagement is essential. This strategy boosts profitability and enables your top talent to concentrate on high-impact opportunities.

- Unify the revenue team by breaking down barriers between marketing, sales, and post-sales functions. Customers see a continuous experience, and your organization should mirror that. Share key metrics and streamline processes to prevent the “handoff” effect, instead providing a smooth, ongoing nurturing journey from initial contact to renewal. Many organizations will attempt reorganizations in 2025; those that succeed will be the ones that realign incentives and culture to prioritize the customer truly. Consider implementing a CRO role or coordinating joint planning sessions to ensure everyone remains aligned.

- Build resilience into your targets and compensation plans for 2026 by revisiting how you set goals. Use realistic assumptions, such as expecting some deals to slip or budgets to tighten, and remain flexible if conditions change. Ensure sales compensation doesn’t unfairly penalize reps for macro factors beyond their control, such as using relative performance or growth from a baseline, to ensure fairness in volatile times. The data indicating most sales teams missed their quotas in 2025 acts as a reminder: avoid outdated quota-setting methods that could demoralize your 2026 team. Focus on adaptability and reward behaviors that support long-term growth, including customer satisfaction and account expansion, rather than only short-term bookings.

Ultimately, the B2B sales organizations that succeed in 2026 will be those that actively adapt now. The landscape has shifted, economic cycles are more unpredictable, buyers hold more power and access to information, and technology continues to transform interaction styles. Clinging to outdated tactics is no longer viable. Luckily, we have extensive insights from reputable research and industry leaders about what the new approach entails. This new playbook emphasizes continuous strategy rather than yearly planning, integrates sales and marketing seamlessly, treats digital skills as vital as effective communication, and considers the ability to handle uncertainty a fundamental competency rather than an afterthought.

If 2024 and 2025 were about responding to shocks, then 2026 should be about developing a sales strategy tailored for uncertainty. By combining macroeconomic foresight, flexible planning, customer-focused approaches, and efficient go-to-market frameworks, B2B companies can not only survive future challenges but also uncover growth opportunities amidst them. The moment to test and reinvent your sales approach is now, before 2026 arrives and compels you to adapt.

![]()

SalesGlobe is a leading sales effectiveness and data-driven creative problem-solving firm. We specialize in helping Global 1000 companies solve their toughest growth challenges and helping them think in new ways to develop more effective solutions in the areas of sales strategy, sales organization, sales process, sales compensation, and quotas. We wrote the books on sales innovation with The Innovative Sale, What Your CEO Needs to Know About Sales Compensation, and Quotas! Design Thinking to Solve Your Biggest Sales Challenge.

Sales Strategy & Revenue Growth Consultant

Data-minded strategist helping organizations align performance, optimize sales design, and drive revenue with precision.