Labor Econ 101: How Might Worker Supply, Employment Demand, and Labor Cost Impact You and Your Customers?

Labor Econ 101: How Might Worker Supply, Employment Demand, and Labor Cost Impact You and Your Customers?

What You Need to Know

- ◆Labor supply is near an all-time high, with five-year growth in leisure, hospitality, healthcare, business and tech services, IT and construction.

- ◆But growth has slowed with August at half of July’s pace with losses in trade, transportation, healthcare, manufacturing, and others.

- ◆Wages have outpaced productivity, up 27% over five years vs. 4.2% for productivity, raising questions about sustainability.

- ◆By sector, the signals suggest lower wages and cost pressures for some and higher wages and growth for others.

- ◆SalesGlobe Signals reveals areas where your business may want to focus.

SalesGlobe Signals is about seeing a bigger, macro view on growth and taking actions that will help you reach your growth aspirations. This month let’s look at some signals on jobs, employment, and cost of labor that may be impacting your customers. Then let's explore how you can create value and expectations for your organization.

With this broader, macro view, our focus is on helping executives answer two questions for their businesses:

1. What Are the Market Signals? Indicators you might watch for your business and what they say about what may be ahead.

2. What Does This Mean for Profitable Revenue Growth? Based on the signals, how you may think about growth for your business and the actions you may consider.

Jobs, Productivity, and Wages are Up, But the Market is Showing Weakness

What Are the Market Signals?

With all the buzz about Fed rate cuts, there’s no shortage of headlines about job growth, unemployment, and the state of the labor market. Headline stats are tossed around in the business press without much context to connect them. What do they really mean for your customers and for you? To make sense of the signals, I thought it would be helpful to revisit Econ 101 class and put S, D, and P to use.

At its core, the labor market is about Supply, Demand, and Price. Think of it as an exercise in fundamentals, except the outcomes drive decisions on hiring, wages, automation, and growth. So, let’s take a practical look at those fundamentals and see what they signal for the road ahead.

Supply of Labor: Continuing to Grow. Before we look at the signals, let's put them in context by defining Supply as the available labor in the market that can be employed by companies. And we'll define Demand is the appetite companies have, to hire and employ that labor.

We can look at labor as a product that the employee has to offer to the market at a price that both agree upon. In simplest terms, when we put together our Supply curve (in green) with our Demand curve (in blue), they indicate a price for that labor at a steady state, or equilibrium.

A change in labor supply by employees or a change in hiring demand by companies for that labor can have implications in terms of price (increases in wages like we saw during the hot labor market of 2021 and 2022), shortages of certain types of labor if qualified people aren't available, or surpluses where perhaps certain job categories are in less demand because some of their work is replaced by AI. This is a simple illustration but can give us a sense of what might happen by industry or job category when we look our market signals. So, if you're now having visceral reactions from flashbacks on economics class, or if you've never had the pleasure of taking econ, we'll pause and shift to the current market signals and then pull it together.

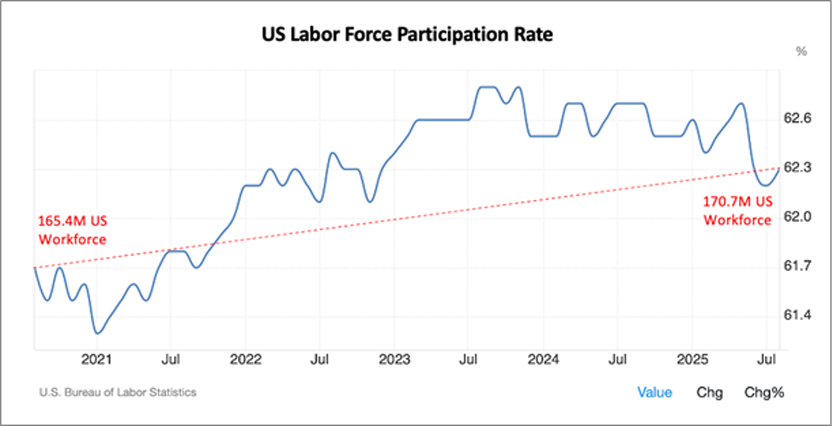

Signal– The workforce supply is growing overall with variations by sector. Looking at workforce eligible labor in the US, supply has grown over the past five years with both an increasing population of workers (from 268M in 2020 to 274M in 2025) and an increasing labor participation rate (including both employed and unemployed) from 61.7% to 62.3% over the same period resulting in an increase in the US workforce of about 5.3M people.

Most of that labor supply growth has been in:

- Leisure and hospitality with a rebound after the pandemic.

- Healthcare due to the demographics of an aging population.

- Professional and business services with growth in consulting and tech services.

- Information technology through the boom in technology growth and the emergence of AI.

- Construction through growing housing demand, prior to the Fed interest rate hikes of 2022, and more recently with reshoring of supply chains.

Labor force growth has slowed in sectors that include:

- Manufacturing with a cyclical reduction in spending due to inflation and deferred purchases as well as early AI adoption.

- Financials with layoffs in banking, insurance, and real estate.

- Retail with shifts to e-commerce and greater automation.

With a growing labor supply, we can look to demand to see how the market may continue to absorb that talent.

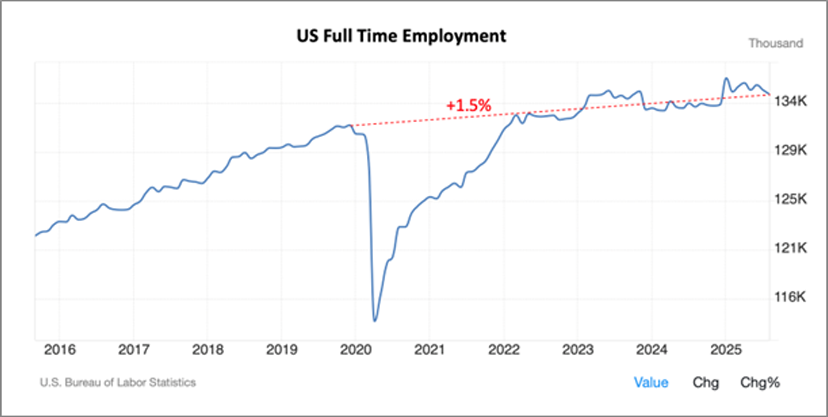

Hiring Demand: Employers Pulling Back. The other side of the market tells a more cautious story. While the US labor supply remains near record highs, hiring demand is slowing. Full-time employment dipped slightly in July and August, though levels remain about 1.5% higher than pre-pandemic.

Signal– Jobs have grown over five years and outpaced labor supply growth. From a big picture perspective, the growth of about 16M employed persons (147M in 2020 increasing to 163M in 2025) has outpaced the growth of participating workers (employed and unemployed) of about 5.3M (165.4M in 2020 increasing to 170.7M in 2025) putting more people to work and bringing down unemployment over that period.

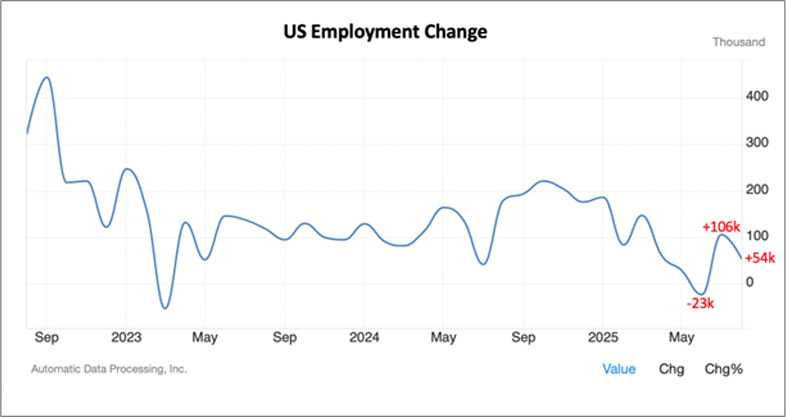

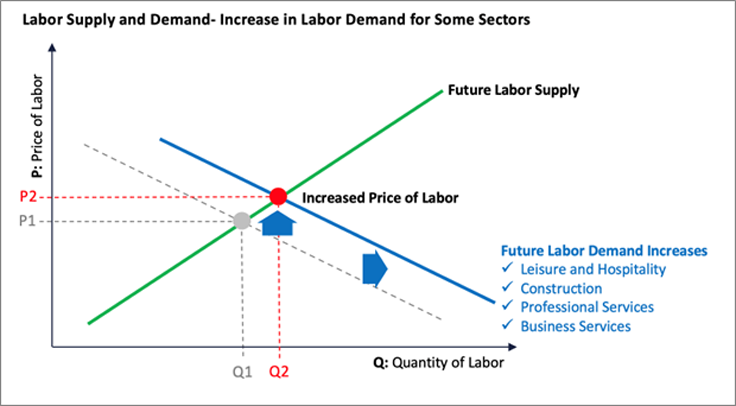

Signal– Recent employer hiring has continued or slowed by sector. At a micro level, employers added 54,000 jobs in August, about half the pace of July’s revised 106,000. Most gains followed suit with growth in workers over the past five years, described above, with growth from services, particularly leisure and hospitality (+50K), construction (+16K), and professional and business services (+15K).

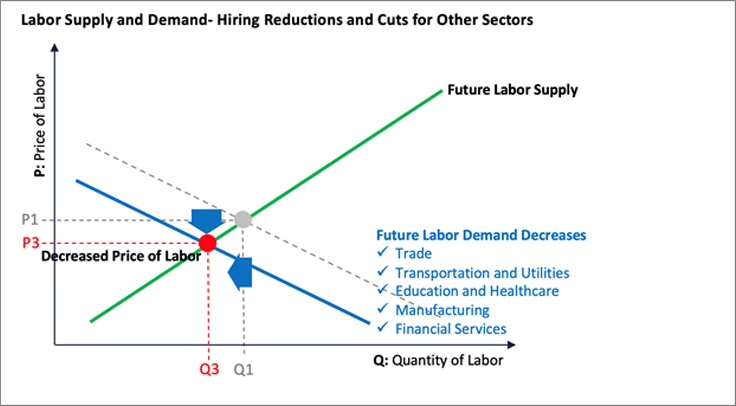

Losses also followed the five-year trend with reductions in trade, transportation, and utilities (-17K), education and healthcare (-12K), manufacturing (-7k), and financial services (-2K).

A variety of factors explain the overall slowing demand including continuing shortages in labor supply in some roles, uneasy consumer demand, and early disruption from AI adoption which may be replacing some jobs.

Signal– Layoffs are increasing. Through 2025, job cuts have accelerated, contributing to the decline in demand. Through the first eight months of this year, U.S. employers announced nearly 900,000 layoffs, up 66% year-over-year and already surpassing 2024’s total. Pharma, financials, and technology are leading the cuts. Employers cite economic and market factors as the primary drivers. Also, in contrast with the traditional view that employee growth signals business growth, with the expansion of AI and increases in efficiency, many CEOs now view employee reductions as a signal of their progress in AI adoption.

With job cuts, initial jobless claims increased to 263,000 in early September, the highest since late 2021, indicating a cooling market. Quit rates have also settled back to 2%, well below the 2021 high of 3%, meaning fewer employees feel confident to leave voluntarily.

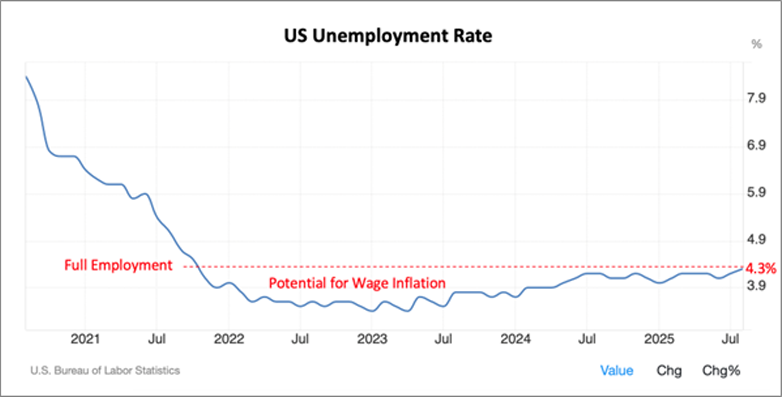

Signal– Unemployment is up but still in the full employment range. Unemployment inched up to 4.3% in August, the highest since October 2021. While this may sound concerning, economists and the Fed consider full employment to between 4% and 5%. Below that level, the market supply becomes tight and can fuel wage inflation as we saw during the 2021 and 2022 "war for talent".

Together, these signals show employers adding jobs in some areas, cutting aggressively in others, and holding the line on voluntary exits.

Price: Labor Costs Stabilizing. The war for talent has eased. Labor costs, as measured by the Employment Cost Index, rose 0.9% in Q2 — flat from Q1 — with wages up 1% and benefits up 0.7%. Year-over-year, costs are increasing at a slower pace of about 3.6%, more in line with inflation than in prior years. Employers are gaining stability in their labor budgets after several years of sharp increases.

For employees, pay gains have been steady, with annual increases of 4.4% for job-stayers and a stronger 7.1% for job-changers, although the premium for employees on job switching is not as great as during the 2021 and 2022 war for talent.

Productivity: Gains, but Wages Outpacing Output. During that five-year period, labor productivity has also grown about 4.2% indicating companies are getting more output per worker. But average pay has increased nearly 27% over that same period. However, employees did not see real benefit from those wage increases but actually saw their buying power eroded by inflation as inflation adjusted household income dropped from $68,010 in 2020 to $67,400 in 2025. So what looked like a major pay benefit for employees and productivity benefit for companies may have turned out flat for both as inflation consumed most of those gains.

What Does This Mean for Profitable Revenue Growth?

Taking a broader view on the dynamics of labor supply and demand can give us some clues about where our customers are now and how what’s ahead may affect them. The signals kay indicate opportunities for your business and customers, depending on industry, company size, and customer base. As executives, the challenge is interpreting which labor trends create headwinds, which open new demand, and how those forces might shape profitable revenue growth in the months ahead.

Continuing hiring for some sectors– opportunities to help customers in growth mode. For business customers, labor trends are splitting across industries. Sectors like leisure, hospitality, construction, professional services, and business services continue to hire at healthy rates, even as overall job growth cools. For companies that sell into these industries, sustained employment growth could signal stronger demand and more resilient budgets.

Also, if we see continued demand for labor in these sectors, with about the same level of labor supply, that could shift out our demand curve and we could see costs for labor increase in those industries (note the new equilibrium point at P2 and Q2 after demand increases (shifts to the right) for the industries I mentioned above. So, you may think about how your business can help those customers in growth mode and a need to potentially offset increasing labor costs.

Slower hiring and cuts for other sectors– opportunities to help customers with increasing costs. In contrast, trade, transportation and utilities, education and healthcare, manufacturing, technology, and financial services are slowing hiring or cutting jobs, in some cases aggressively. Customers in those sectors may tighten spending or slow projects, creating a drag on their suppliers. Where labor costs are rising faster than productivity, many companies will turn to automation, process efficiencies, or external solutions to close the gap. These could also be opportunities for your business, depending on your offers, to help customers in these industries.

Consumer cost pinch– opportunities to help consumer customers with budgets under pressure. On the consumer side, the story is equally mixed. Rising unemployment and slowing wage growth suggest households are beginning to feel the squeeze, which often translates into more cautious spending on discretionary categories. At the same time, employed workers, particularly those willing to switch jobs, are still seeing increases in pay. For now, that helps sustain consumption in certain segments, but with less momentum than in prior years.

Stabilized labor costs but still short of productivity gains– opportunities to help customers increase efficiency. Across both business and consumer markets, stabilizing labor costs offer a measure of predictability. Employers are no longer bidding up wages at the pace seen in 2021 and 2022, which should help ease pressure on margins. Yet productivity growth, as I described before, is not fully keeping pace with wages. That mismatch suggests a strategic opportunity: organizations that can help customers supplement labor with products or services that boost efficiency will be in demand. At the same time, AI adoption is beginning to reshape the equation, creating the possibility that some industries will grow revenue with fewer employees.

So, with changes in these big economic signals, rather than looking at the market as a whole, your organization can take action on meaningful trends by looking how these economic factors impact each of your segments.

Ten Questions About Your Customer Strategy for the Labor Market. To set your direction, here are ten questions you may ask your organization:

- Which industries are expanding headcount, and how aligned are we to serve them?

- Which industries are contracting, and how might this affect their buying power?

- What risks do job cuts in trade, transportation and utilities, education and healthcare, manufacturing, and financial services create for our business?

- Where can we supplement labor shortages with products or services that boost productivity?

- How might automation and AI adoption shift customer needs and timelines?

- Which industries can absorb higher labor costs and which will struggle?

- How exposed are our target customers if unemployment continues to rise?

- What value proposition adjustments can address cautious consumer and business spending?

- How can we better support customers who are struggling with labor-related volatility from wages to turnover?

- Where can we focus on industries that are growing but holding off on employment, and may need products or services to supplement their workforce and fuel growth?

Your Call to Action

Each of the ten questions and the potential impacts on the business and consumer segments should prompt valuable conversation and ideas around your business and your Customer Strategy for Fed Rate Reductions.

Look at each of the signals we've discussed around interest rate changes. Then, consider their impact from two perspectives: How will they affect your customers and their ability to grow? How will they affect your business?

Get beyond current state and ask your team where they see the signals projecting ahead and what this means for your organization's profitable growth. Consider each of the questions I've asked, add your own, create a plan, and get into action. Questions for us? Email us at info@salesglobe.com or contact us at SalesGlobe.com. ______________________________________________________________________________

SalesGlobe be is a revenue growth consulting and services firm focused on helping our clients reach their growth aspirations through better solution development and operationalizing to get results.

Founder and Managing Partner at SalesGlobe

“We help companies solve tough sales challenges to connect their sales strategies to the bottom line.”